FX Global Code of Conduct

A global, diverse market needs a common set of guidance to promote integrity, effective functioning and to instil confidence. The FX Global Code (“the Code”) is this set of global principles of good practice in the FX market.

About the FX Code

What is it and why is it needed?

The foreign exchange (“FX”) market is unique and inherently complex with markets open globally 24 hours a day across multiple trading venues with no single price available. Market participants are diverse and act in different capacities from principals to agents and liquidity consumers to providers – including amongst others, banks, asset managers, corporates, and central banks – each interacting with the market in different ways to meet different objectives.

The FX market is often perceived to be a complex and diverse market. The FX Global Code of Conduct (“the Code”) seeks to provide a common global set of guidance and principles to promote integrity, effective functioning and to instil confidence. It was developed in 2017 and updated in 2021 by a collection of central banks, traders, industry associations and other market participants (including the buy-side [1] ) who agreed to a common set of principles to ensure the fairness, efficiency, and transparency of the FX market.

The Global FX Committee (“GFXC”) also established in 2017, is a forum bringing together central banks and private sector participants to promote collaboration and communication on FX matters, exchange views on trends and developments in FX markets as well as to promote, maintain, and update the Code.

The Code has six leading principles which are applied proportionately [2] according to each Market Participants [3] involvement with the FX market. Market Participants are expected to:

Six Key Principles

- Ethics - Behave in an ethical and professional manner to promote the fairness and integrity of the FX Market.

- Governance –Have sound and effective governance frameworks to provide for clear responsibility and comprehensive oversight of their activity and to promote responsible engagement in the FX Market.

- Execution - Exercise care when negotiating and executing transactions to promote a robust, fair, open, liquid, and appropriately transparent FX Market.

- Information Sharing - Be clear and accurate in their communications and to protect Confidential Information to promote effective communication.

- Confirmation and Settlement - Promote and maintain a robust control and compliance environment to effectively identify, manage, and report on the risks associated with their engagement in the FX Market.

- Risk Management and Compliance – Establish robust, efficient, transparent, and risk-mitigating post-trade processes to promote the predictable, smooth, and timely settlement of transactions in the FX Market.

Spotlight on the FX Global Code of Conduct: Treasury Benefits

Eleanor Hill

Editorial Consultant, Treasury Management International (TMI)

Lisa Dukes

Co-founder, Dukes & King

FX Global Code Proportionality Self-Assessment Tool

Try out the FX Global Code Proportionality Self-Assessment Tool, which identifies the 55 Principles of the Code in proportion to your role as a Market Participant in the FX market. In the following you will be answering a series of questions about your activity in the FX market as a Market Participant. In the end you will be able to download a report which highlights the Principles which apply to you.

Digital Proportionality ToolWhy should a corporate adhere to the Code?

Adopting the Code benefits both each individual institution as well as the FX market as a whole.

I. Proportional best practice framework

For corporate buy-side market participants engaging in the foreign exchange market, the Code provides a set of standards to be followed to ensure that their trading activities are conducted in a manner which is ethical, fair and transparent. As a result, it can be used as an invaluable framework for risk management policies and procedures for any organisation.

It also provides a framework for professional behaviour when trading in the FX marketplace, protecting participants from malpractice and limiting the potential for conflicts of interest. Additionally, it encourages good market practices that promote liquidity, price discovery and execution.

II. Opportunity for Improvement – Operations and Knowledge Base

The Code, whilst applied proportionally for each Market Participant, can assist in setting aspirations for the future, and/or improving internal operational FX processes whether part of ongoing development, growth or change cycles.

In addition, the Code fosters important and relevant understanding on key topics in the FX market which can be used to strengthen and educate to ensure the breadth and depth of a team’s knowledge and application.

III. Stakeholder Comfort

By signing up to the code it evidences a deeper investment in governance - adapting procedures and ensuring all employees have the correct level of knowledge. All stakeholders can share in the confidence that the right governance is in place and that the institution is informed and responsible in its dealings with the FX market -whether that is the board, investors, or wider stakeholders.

It should be considered as an important step in risk management and compliance programs. It serves as an independent benchmark against which the corporates practices can be evaluated as well as a point of reference for when there is a dispute between market participants.

IV. Level the Playing Field

The code is for the benefit of all Market Participants regardless of the extent of interaction. It fosters a level playing field between buy- and sell-side participants focussing on quality of pricing and execution for all.

Corporates who are well versed in the Code have a competitive edge when demonstrating their conduct credentials, reducing the risk of disputes, making it easier for them to access competitive pricing whilst demonstrating that their activities adhere to the highest standards of professional conduct.

As more corporates adopt the Code the buy-side community’s voice strengthens in the FX Market.

Adopting the Code

The Code doesn’t look to impose any additional legal or regulatory obligations. By adopting the Code an institution is confirming that they are committed to monitoring and self-regulating against the standards of good practice.

Signing the Statement of Commitment to the Code means that a market participant has taken appropriate steps, based on the size and complexity of its activities and the nature of its engagement in the FX market, to align its activities with the principles of the Code. Market participants should therefore consider what the appropriate steps are to ensure that their Statement of Commitment remains accurate over time. These steps will be vastly different from a small treasury team with small but regular FX dealings versus a bank with onerous infrastructure needs.

The GFXC has developed an online tool to assist in this review, organising the 55 principles based on a participant’s role in the FX market, streamlining and simplifying the adherence process and supporting those market participants with less complex activities adopt and adhere to the Code.

Corporate Case Study

A corporate buy side market participant who wishes to sign up to the Code. As part of their signing up process, they have familiarised themselves with the 55 principles covering the 6 key areas of the Code.

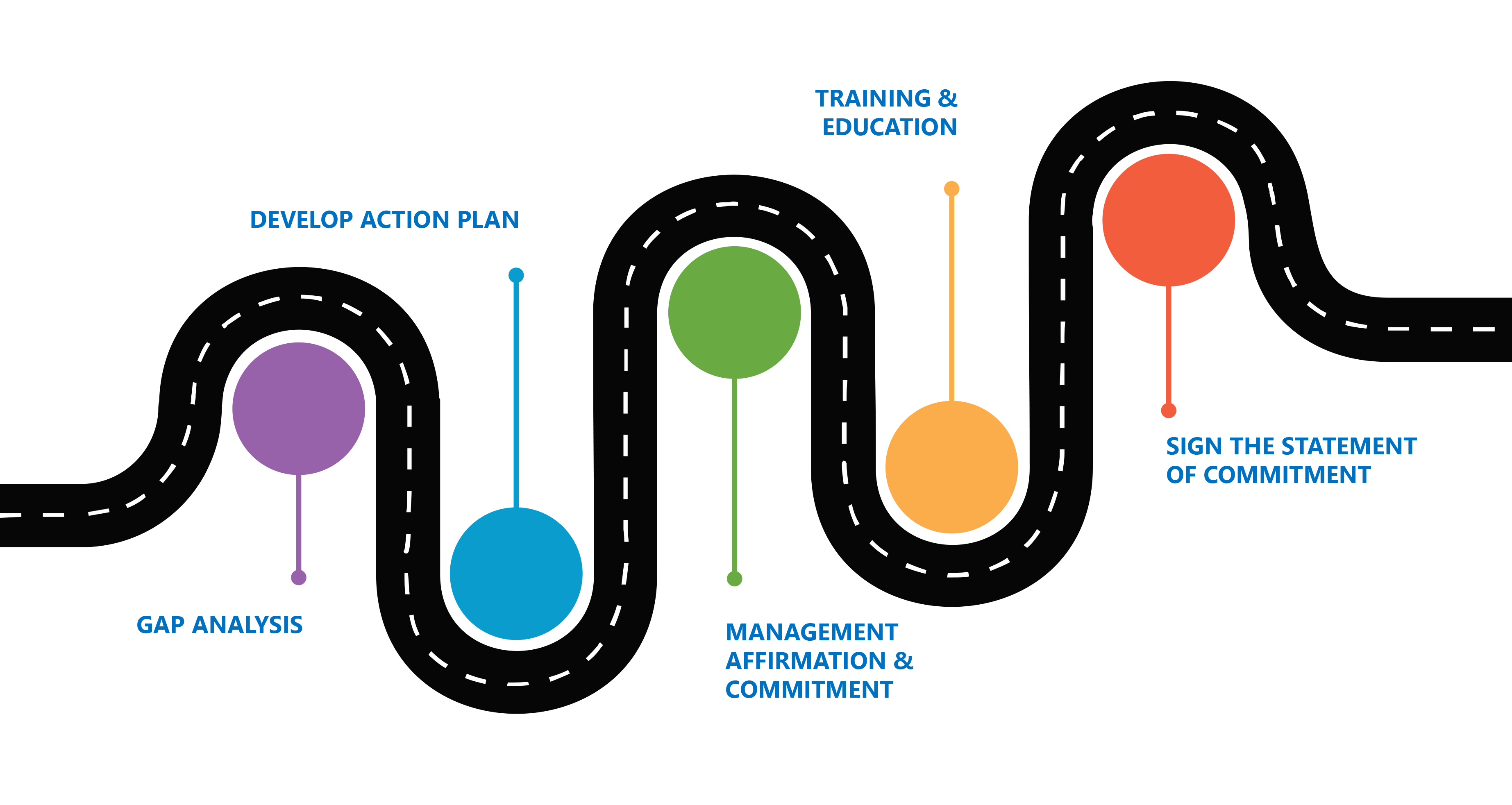

Stage 1 – Gap analysis

A new project group connecting all relevant internal business areas at XYZ Group was established. In the first stage of the project the XYZ project team set out to:

- Identify relevant FX activities within the Group;

- Evaluate the relevant principles and how the Code’s concept of proportionality should be applied;

- Undertake a gap analysis between internal policy, procedures and controls against the applicable proportionate principles;

- Understand the impact on XYZ Group of those principles not directly relevant to the group but through interactions with other market participants e.g. handling client orders.

Stage 2 – Develop action plan

Once the XYZ project team had identified the areas of focus, an action plan was created to align the internal processes to the principles of the Code. A traffic light review of tasks clearly communicated both the importance of the changes but also an expected timeline where actions were for future enhancements and aspirations rather than imminent improvements.

Stage 3 – Management Affirmation and Commitment

The next consideration for the XYZ project team was to review the existing oversight and control frameworks to ensure that once established the Code adherence would be regularly reviewed and monitored. It was determined that two changes would be made:

- Embed the FX Global Code adherence within the Treasury owned FX Risk Management Policy, ultimately owned by the CFO accountable to the board, requiring at least annual review and sign off.

- Include within the internal audit review cycle.

The XYZ project team presented the gap analysis, action plan and proposed policy changes to the appropriate risk committees and garnered support to adopt the Code.

Stage 4 – Training and Education

Prior to signing up to the code, the XYZ project team cascaded their findings, the new processes and understanding of the principles of The Code to all affected individuals and departments.

In addition to the 55 principles, the XYZ project team shared the additional practices laid out in the Code including, for example, best practices for dealing fairly with counterparties and managing emerging risks.

Stage 5 – Sign the Statement of Commitment

XYZ Group agreed that the Group Treasurer was best placed to sign the Statement of Committee which was filed on a Public Register.

- [1] Buy-side refers to market participants who take or “buy” the services of the sell-side. This includes for example corporates, insurance firms, hedge funds and pension funds. The sell side facilitate the market and provide liquidity – typically banks.

- [2] Proportionality: market participants adopt the code in line with their level of engagement in the FX market and with the size and complexity of their operations.

- [3] A Market Participant is an entity (not retail investor) that is regularly active in accessing the FX Markets directly or indirectly through other market participants or that operates a FX execution platform/system or that provides FX benchmark execution services.