Prior to the coronavirus crisis, few corporates had thoroughly reviewed the way they processed their foreign currency payments. But with remote working and rapid digitisation, treasurers are starting to explore the benefits of automating their transactional foreign exchange (FX) workflows. Sat Khuntia, Head of FX Sales, Barclays Corporate, and Daniela Eder, Head of Payments & Cash Management Europe, Barclays, examine the ways in which the FX payments ecosystem is evolving and outline a range of digital tools that could assist treasurers in the post-Covid-19 world.

There’s an old adage that says, “don’t fix something if it isn’t broken”. And many corporates had taken this attitude towards their transactional FX workflows, until the pandemic hit. Before the crisis, transactions were agreed with counterparties, spot FX deals were made, and cross-border payments were initiated. Transactional FX was simply part of business as usual – and, often, little thought was given to the potential for operational efficiencies and strategic gains by improving these workflows.

The turning point came when treasury practitioners across the globe began working from home and currency volatility skyrocketed. As Khuntia explains: “When the world went into lockdown, treasury staff were faced with the reality of making FX-related payments, dealing with foreign currency receipts, and managing the company’s working capital in multiple currencies, via remote channels. Initially, many struggled to access the necessary systems from home and the amount of manual work involved in transactional FX workflows was highlighted.”

Treasury leaders soon began to question the validity of such a manual approach in a world that was shifting rapidly towards digital and automated solutions. “The inherent risks involved in manual FX processes also became apparent – and the crisis has provided a huge incentive for treasurers to take greater control of risks, maximise operational efficiencies and unlock growth opportunities,” he continues.

Increased volatility in the FX market has also added to the interest in automated solutions, says Khuntia. “At the start of 2020, the economic environment was relatively benign. Volatility in the euro even reached a record low in mid-January [1]. Soon, though, markets caught wind of the emerging coronavirus crisis and volatility began to spike. By mid-March, the US dollar was in enormous demand as investors looked for a safe haven and a number of corporate treasurers were taken by surprise. FX volatility quickly rose up their list of concerns.”

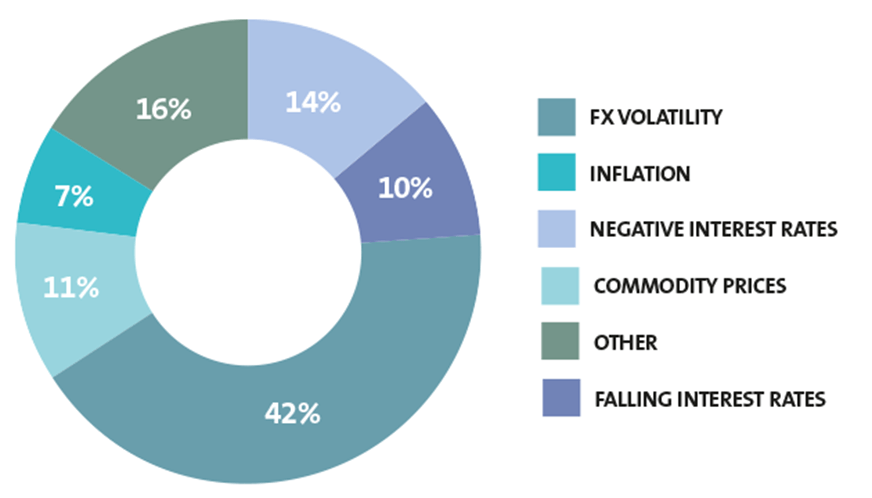

This is borne out by the results of a new research report published by TMI, in partnership with Barclays, which surveyed 300+ treasury professionals and CFOs on current European treasury trends. According to the report, entitled New Europe: Is Your Treasury Fit for the Challenge?, 42% of respondents see FX volatility as their number one macroeconomic concern for the year ahead (see fig. 1).

Fig 1: What is your top macroeconomic concern for 2020? |

Real-time transparency

With the full economic impact of global lockdown becoming apparent, cash flow uncertainty also became a significant concern for treasurers. Goods and services could not be consumed at the same volumes, or in the same way, as before. Khuntia observes: “Not only did this put greater pressure on treasurers to have real-time visibility and transparency over their cash management and FX risk management, it also saw a shift in business models towards digital channels, which directly impacted treasury.”

Eder agrees, adding that: “E-commerce has had a significant boost [2] from the pandemic and many companies have expanded into new markets via digital channels. This presents treasury functions with fresh FX challenges – from paying new suppliers in local currencies, to selling goods and making refunds in foreign currencies. Treasurers are therefore having to deal with increased risks from currency conversions and fluctuations, as well as a lack of pricing transparency, varying transaction costs, and operational risks.”

On the upside, this focus on transactional FX is a great incentive to embrace technology which can help to transform FX payments into a strategic tool for boosting sales, building stronger buyer/supplier relationships, and improving both cash and risk management. “There is a whole ecosystem of solutions available in the wider market to support transactional FX, ranging from instant payments and SWIFT gpi (see box 1) to automated FX risk management tools from banks and vendors. Fintechs also have a role to play, as do technologies such as application programming interfaces (APIs),” says Eder.

Bringing this to life, Khuntia shares some examples of best practice from clients he has worked with: “We have a number of clients who have already embraced automated FX solutions via our online banking channels. One functionality that has proved popular, especially since the crisis began, is the ability to upload a payment file onto our cash-management channel and have the pre-agreed FX rate automatically applied to each payment in that file.”

Eder adds: “This means that there are no hidden fees and there is no manual work required – which vastly reduces error rates. Rather than treasury personnel being tied up filling in FX rates for hundreds of individual transactions, a single payment file can be uploaded at the touch of a button and the legwork is done for them – enabling them to be redeployed to more strategic tasks. What’s more, all of the information about the payment can be viewed online in real time, providing total transparency.”

Automated FX solutions also exist for those corporates needing to make refunds in local currency to customers. Khuntia continues: “Sectors such as travel have been inundated with refund requests as a result of global lockdown. With buyers and sellers typically in different countries, making refunds can result in FX exposures where rates have changed since the time of purchase. Via our automated FX channels, we can provide cancellation/refund cover, which means that if a cancellation or a refund happens on a transaction after several weeks, we remove the FX risk by automatically giving them the original rate used. All of this functionality happens behind the scenes via API and has been a huge benefit for clients during the crisis.”

Box 1: Smarter payments

It is not just automated FX solutions that are enabling corporates to improve their transactional FX workflows. Advances in the payments’ ecosystem are also having a significant impact. Eder comments: “Instant payments are accelerating the move towards interoperable payment standards across the globe, with regulators working on adoption of ISO 20022. Initiatives such as SWIFT gpi are also looking to establish real-time cross-border payments as the ‘norm’ – and this brings with it the ability to gain much greater visibility and transparency over transactional FX.”

What Eder is alluding to here is the SWIFT gpi Tracker, which via a unique end-to-end transaction reference (UETR), enables corporates to view the progress of a payment between banks in the payment chain, as well as having complete visibility over any deducts, including fees and FX rates.

Thanks to regulations such as the revised Payment Services Directive (PSD2), new players – in the form of payment service providers (PSPs) – are also shaking up the cross-border payments space. “Corporates have more and more options for making international transactions. They can make payments via the cloud, through fintech services, for example. Banks are also increasingly partnering with PSPs as a way to offer the most innovative digital payments capabilities to their clients,” she notes.

The beauty of these solutions is not only the choice, speed and transparency they enable, but also the fact that they are digitally native. This enables easy automation of payments workflows.

Ongoing evolution

On the subject of APIs, Eder believes this is one area where the automation of transactional FX will continue to evolve in the future. “APIs are already being used by many large corporates to consume FX rates and I believe this will be a growing trend,” she notes. Khuntia agrees, adding that “the benefits of the API solution are that it’s a live channel and on demand – the client’s computer requests FX rates and they are sent instantly from the bank. If the corporate wants to undertake a transaction, they then simply make the instruction and the deal happens instantly. APIs are also extremely secure, which is important in these days of heightened cyber risk”.

Making progress happen

For those treasurers looking to make efficiency gains and strategic advances in their transactional FX sooner rather than later, Eder shares some tips:

- Don’t stop the continuous improvement journey. “Many corporates have been distracted by the Covid-19 crisis, when really it is a great opportunity to get things done. Focus on the areas that are clearly inefficient – like manual workflows around FX payments – and explore automated solutions,” she notes.

- Educate yourself on the technologies available. “Not every solution is right for every corporate. As discussed, there are many payment technologies out there and numerous automated FX solutions. Speak with your banks, vendors and fintechs to understand the possibilities. Also interact with your peers to see what can be done in-house before adding external solutions,” Eder comments.

- Implement those technologies. “Often corporates spend a long time researching technologies but never implement them, or wait too long before putting them in place and things have moved on. The only way to get ahead is to make the move!”, she suggests.

Khuntia echoes this, adding that automation of transactional FX processes could bring significant benefits in a post-pandemic environment. “The world of work is unlikely to return to its pre-crisis levels anytime soon. Treasurers will once again be looking to do more with less – and automation of FX workflows can lead to significant time savings, freeing up personnel to tackle more value-added tasks and make smarter, faster decisions. It will also reduce the risk associated with manual FX payments, which can only be a good thing.”

His final words of wisdom for treasurers looking to go down the automation path are to ensure that any digital treasury projects dovetail with the digital strategy of the wider business. “The crisis has led to rapid shifts in business models, with companies embracing digital channels like never before. To grow with the business, and help the company reach its international growth goals, treasury must be on the same page in its digital execution. This is not to say that treasury cannot lead the digital discussion – it absolutely can – especially when armed with up-to-date insight on the latest technologies,” he concludes.