Gone are the days when Europe had just a handful of ‘traditional’ trading partners. Over the past several years, European trade corridors and patterns have shifted significantly, with greater emphasis on emerging markets and local currency transactions. As this pivot continues, corporate treasurers are encountering new challenges from an FX risk management standpoint – and companies must adapt their hedging strategies, international payments processes, trade finance arrangements, and technology stacks in order to thrive.

Playing cards, porcelain, gunpowder, paper money, and printing-press technology. All these items were introduced to Europe from China via the Silk Road [1] – a vast network of trade routes that connected the East to the West from the second century BCE to the mid-15th century.

While the logistics of trade may be very different today, China is once again one of Europe’s top trading partners – together with a growing stable of emerging market economies. According to Gibran Maqsood, Head of Transactional FX Sales, Europe, Barclays Corporate Banking, “Several interesting changes have taken place in the European cross-border trade landscape in recent years, especially around trading partners and currencies.”

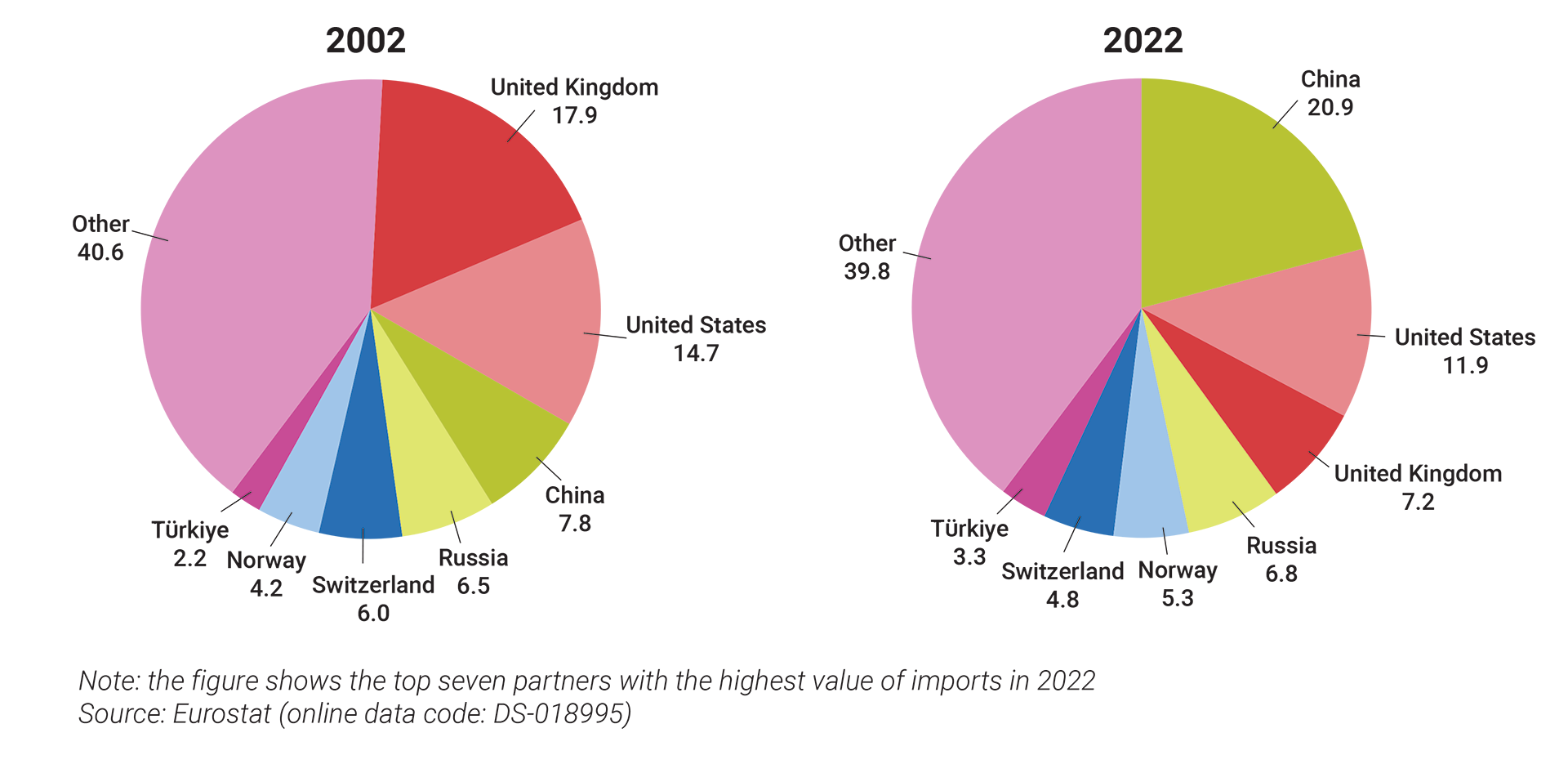

Although the majority (59.9%)[2] of EU trade – imports and exports combined – still occurs within the single market, extra-EU trading relationships are shifting, he says. “There has been a notable transition in the focus of bilateral trade towards emerging economies, especially China, whereas trade interactions with long-standing partners have generally progressed at a slower rate.” (See box on next page for detailed country-level statistics on trade shifts).

Trading places

Michaël Hache, Head of Trade & Working Capital France and Benelux, Barclays, elaborates on these shifts: “Looking at both imports and exports, Europe’s traditional trade relationships have experienced heavy disruption – especially since 2020 – due to Covid, the increase in geopolitical tensions, including the ongoing impact of Brexit, rising interest rates, terrorist attacks disrupting cargo routes, and international sanctions.”

This uncertainty is leading to greater interest in trade solutions, says Hache, with a marked uptick in the need for inventory finance, as well as ESG-compliant solutions. “Corporates are looking to reinforce their supply chains against further possible disruptions, which means having sufficient raw materials on hand to produce their goods, and enough inventory to fulfil demand in a timely manner. But higher inventory can weigh heavily on working capital, so inventory finance is definitely experiencing a resurgence among European traders, and we expect that to continue throughout 2024.”

Trade statistics tell the story

The shift in trading partners is especially noticeable on the imports side. “It’s natural to imagine that the US and UK make up a significant portion of EU imports, but China was the EU’s principal partner for imported goods in 2022 – with 20.9% of the total share, up from 7.8 % in 2002, according to the most recent full-year data from Eurostat[3],” highlights Maqsood. The US came in significantly behind China at 11.9%, followed by the UK, Russia, and Norway. Other developing economies such as Türkiye and India also featured in the top 10 countries from which goods were imported to the EU in 2022 (see chart 1).

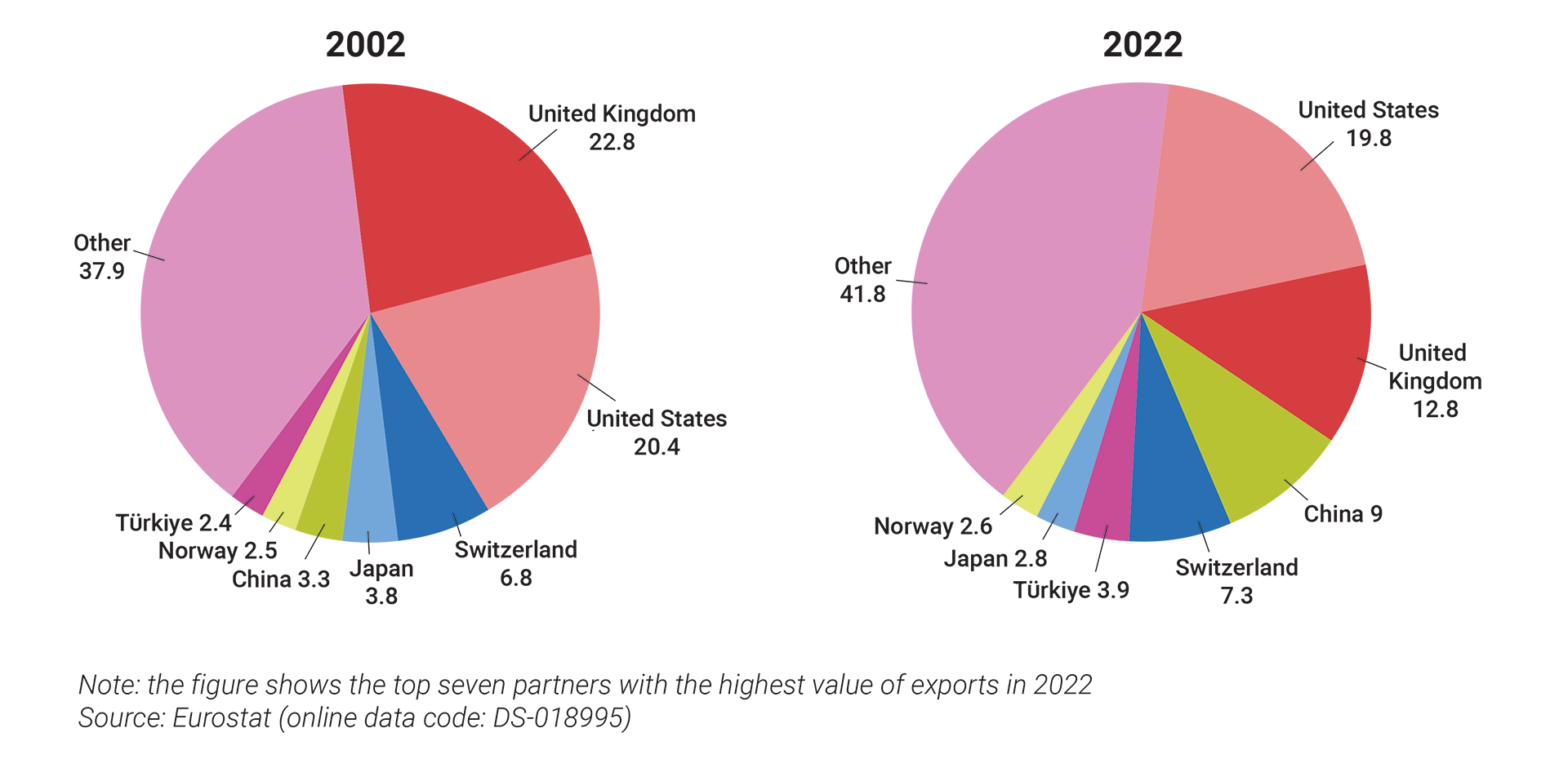

Meanwhile, the main destinations for goods exported from the EU included the US, the UK, China, Switzerland, and Türkiye, among others (see chart 2). “Again, China saw a huge leap in the two decades from 2002, with the value of the country’s share of EU exports growing by a staggering 603%[4] in that time,” highlights Maqsood. Nevertheless, the EU posted a record trade deficit with China of €390bn in 2022[5] – pointing to a significant imbalance between imports and exports.

By contrast with the China story, the rate of export expansion among the EU’s conventional trade allies and developed economies across the globe was notably sluggish. Exports to Russia also exhibited limited growth due to imposed export restrictions as a result of the invasion of Ukraine.

Hache has also observed many corporates making their supply chains more resilient by sourcing from new or additional locations. “Alongside China, we are seeing the rise of countries such as Mexico and Türkiye in European supply chains. As a result, the currencies in which Europe’s trade transactions are carried out are also evolving at speed.”

Olivier Chokron, Director, Corporate FX Sales, Barclays, echoes this, adding: “The Chinese yuan [CNY] is becoming much more important as an invoicing currency for European trade, since corporates understand the potential price and relationship benefits of trading with suppliers in their local currency. At the same time, CNY is now a key component in the currency mix of revenues for European companies that sell more and more to Chinese consumers.”

The Russian invasion of Ukraine has also contributed to an increase in the yuan’s significance, Chokron says. To support this point, he refers to Beata Javorcik, Chief Economist, European Bank for Reconstruction and Development, who wrote in a recent paper[6]: “We have also observed an increase in the use of the yuan as an invoicing currency by third countries. Thus, while dollar dominance makes sanctions more effective, the sanctions could, in the long run, lead to some erosion of this dominance.”

European trade with many other emerging market economies, not only the largest ones such as India or Brazil, is also on the up. Chokron comments: “Some of our clients sell in over a hundred countries. Treasurers are suddenly being exposed to a whole new basket of currencies, which have financial risk implications in terms of exchange rates on international payments and, of course, hedging strategies.”

From a practical perspective, this means that European treasury teams have more FX risks to manage and monitor, usually with the same resources. “With a new range of FX risks to handle, most companies have adopted a systematic approach when it comes to hedging secondary exposures, in order to focus their efforts on the management of their primary exposures,” confirms Chokron.

But achieving this is not always easy. “Hedging emerging market currencies can be a different ball game from hedging, say, the pound sterling. It can require understanding of local regulation and the factors affecting the value of the currency, as well as requiring attention to be paid to liquidity conditions, and being prepared to face a higher cost of hedging too,” he notes.

The same challenges are arising in the trade and project finance space, says Hache, leading to a more creative hedging approach. “Often, we see that sourcing may be different from the geography of the buyer’s headquarters and may happen in the country of destination of the project. In this instance, buyers may want to explore financing some of their purchases for the project in the local destination currency, thereby creating a natural hedge with the cash flows to be generated by the project.”

While Chokron also sees more corporates exploring natural hedges across their portfolios, he says that another area to explore in order to reduce potential losses is removing fixed exchange rates from commercial contracts with their clients. “In 2023, we saw huge devaluations in currencies such as the Argentine peso, the Egyptian pound, and the Turkish lira. As such, corporates with contracts in these currencies were understandably reluctant to lock in rates.”

Treasury teams can also adapt to different environments by “thinking smart” about hedging: they can optimise the maturity of their hedges to keep hedging cost to a minimum, or selectively use options. Chokron continues: “FX options have increasingly been on the radar either because option premiums look cheap in the context of the geopolitical risks ahead of us, or because they offer more flexibility in the hedging profile without necessarily creating an additional accounting headache.”

Chart 1: EU imports of goods 2002 vs. 2022

Chart 2: EU exports of goods 2002 vs. 2022

Spotlight on transactional FX

While large international contracts and trade finance deals will inevitably attract attention where FX is concerned, Maqsood points to the need to be increasingly aware of the FX implications of cross-border payments – regardless of the size of the transaction.

“The FX element of international payments, or transactional FX as we call it, can be significant. It is typically a low-value, high-volume game. But even many seemingly small transactions in foreign currencies, such as salary payments or invoice settlements, can add up. In short, the cost and workload of transactional FX can materially impact the bottom line.”

Consequently, treasury teams are requesting more automated and streamlined solutions for transactional FX, which not only simplify workflows but also cater to the growing basket of currencies they are dealing with. “Among our European treasurers, East Asian currencies are the most frequently requested, although African currencies are also on the rise – and we’ve been rapidly expanding our offering there,” comments Maqsood.

There may be instances where treasury teams cannot access appropriate hedging tools for these exposures, often because the size of the transaction is too small. “But as a bare minimum, they can use transactional FX tools to perform the currency conversion in order to reduce risks,” he suggests.

Alongside the workflow benefits and improved risk management potential, automated solutions leveraging near real-time rates also help to deliver price transparency. “The payer no longer has to guess what the cost of the conversion will be, or find out afterwards that it was more than they expected. They know and agree upfront. And the rates are [virtually] real-time, so there are no nasty surprises,” explains Maqsood.

No wonder, then, that this type of capability is being increasingly requested in RFPs, according to Maqsood. “Transactional FX risk is certainly being more widely recognised by corporates. What’s more, as technology evolves, and becomes more accessible, automated tools that provide simplicity in workflows and transparency over pricing are becoming part of the treasury armoury for multinationals of all sizes.”

Of course, regulation is also driving corporate attentiveness, Maqsood admits. “There is growing focus on the margins being charged and how FX is priced. Corporates are also increasingly aware of best practice with initiatives such as the FX Global Code of Conduct. As such, we expect to see greater interest in these solutions as 2024 progresses.”

Chokron concurs. For him, there is no question that FX will remain a closely monitored asset class by all corporates, with demand for risk management solutions only set to rise. “FX volatility is not going away. For example, almost half of the world’s population will experience an election, and potential change of government, in their country this year[7]. That will inevitably cause FX market upsets along the way.

“What’s more, emerging market currencies have been performing well of late – take Brazil and Mexico, for instance. But, as treasurers will know all too well, emerging market currencies are not as stable as those in developed nations. So, while the outlook may be positive, caution is required, especially when central bank policies across the globe are becoming more dovish. And as interest rates potentially fall again, those emerging market locations may become less attractive to investors – all of which will impact the currency market,” Chokron cautions.

Meanwhile, the ongoing conundrum of rising energy prices in Europe is weighing heavily on growth predictions. “The skewed balance of trade with China, which Gibran highlighted earlier, is also a concern as Europe’s growth is now more closely tied with China’s own growth. And naturally there is a correlation between countries’ growth, the performance of global stock markets, and the FX market.”

These many variables, all requiring a close eye to be kept on them, are precisely why a systematic approach to FX hedging is so important.

Technology is the only certainty

Elsewhere, Hache expects the recent upturn in the volume of trade finance to persist throughout 2024, in tandem with continued geopolitical uncertainty. “My view is that the year ahead will see many more trade solutions deployed by European companies for their supplies in China, but also more in India and Vietnam, for example. These are two very ‘hot’ geographies, given their relatively low manufacturing and import costs. They are also more distant from geopolitical tensions, making them new favourites among many European buyers.”

Despite the willingness of corporates to explore new sourcing locations, Hache also predicts understandable caution. “With the ongoing global uncertainty, elections on the horizon in several major economies, not to mention ambitious energy transition plans in many nations, which present both opportunities and threats, I expect a greater scrutiny on country risk and counterparty credit risk in 2024,” he says.

If sovereign risk comes to bear, and defaults in that country rise, trading relationships will inevitably start to shift once again. As such, it is important to have flexibility in any trade arrangements that are put in place.

Hache adds: “Thankfully, the increasingly digital nature of trade and the sophistication of trade platforms makes this kind of pivot easier to manage.”

Maqsood agrees, concluding: “The rise of technology and its ability to help manage the risks associated with international trade should not be underestimated.

“Even if a treasurer feels they already have a good solution in place for managing their FX exposures, including transactional FX risk, it is worth taking stock and talking to your bank to see if newer technologies, supported by APIs or perhaps AI and ML, could make your set-up even more efficient.”

Improving transactional FX risk management

When considering how to revamp the management of FX risks associated with low-value, high-volume international payments in 2024, questions to consider include:

- How does the company currently manage transactional FX risk? Is there an active approach in place with the company’s cash management bank or payments provider? Or is transactional FX risk not considered a priority, unlike other FX exposures?

- Can treasury quantify the risk posed by transactional FX? How significant is it? Are any metrics in place? Can data be collected in-house from the TMS to assist? Could banking partners provide the relevant data instead? “If the turnover and average margin can be determined, then the total cost can be calculated – and this is a great place to start,” Maqsood urges.

- Is transactional FX risk aggregated and managed centrally? If not, explore how technology solutions such as APIs could assist in achieving central visibility and control – together with automated, streamlined workflows, and real-time price transparency.

- Could your provider offer more? As clichéd as it might sound, picking the right provider for transactional FX risk solutions can make a significant difference. Maqsood elaborates: “Together with the usual reliability and relationship factors, treasurers will want a provider that has capabilities in a large range of currencies, as well as a partner that leverages the latest technology to provide the right level of transparency and visibility.” Innovation is also critical in this space and Maqsood recommends that corporates have constant dialogue with their provider around new functionalities they would like to see in the future.